A treasure trove of information exists within a group of 5 ledgers which have been stored in a Wreningham property for over 125 years and recently re-found! They are a collection of “Highway Rate” books: a record of the taxes gathered by a village “Surveyor” and handed over to the County of Norfolk as our village contribution for the maintainance and repair of highways.

County Directories have identified three Surveyors for Wreningham who were responsible for collection this Highway Rate tax. The first of these was James Day who had the role between 1858 and 1865. John Bullimore was Surveyor between 1881 and 1883. Finally, Dennis William Long was the Surveyor from 1884 to 1894. The lack of information about village surveyors in other years may simply mean that county directory authors had not been aware of them.

The Highway Rate

During the period of the 5 Wreningham Highway Rate books, this tax collection was authorised under the Highways Act of 1862. The details of the money due, including the applicable tax rate, were written into the books. The tax was based on a small percentage of the assessed “rateable values” of each property – typically, two or three pence of tax for every £1 of property “Rate” value. As with today’s Council Tax, those with more highly valued property paid more tax.

The Books

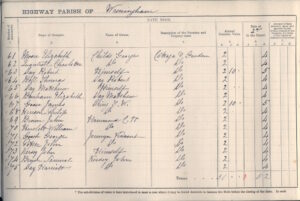

Each book is 10 inches wide and 7 1/4 inches tall; a double inside page scanned from one of them is pictured below. In 1885/6 the total rateable vale of Wreningham was £2,576 whilst £21 1shilling and 9½ pence was collected for repair and maintenance of the roads.

The Highway Rate books have robust maroon covers and were printed by “Jarrold & Sons, London and Norwich”. Each double page sets out the tenants / owners and rateable values to the left side and the moneys collected (and any non-payments) on the right side. The books roll up into cylinders – and each can be tied around its circumference with a legal ribbon which is fixed to the rear cover. The rear cover is also significantly wider than the standard page; this excess rear cover width then wraps around the entire book for protection and also makes a rolled up book easier to carry.

The 5 Wreningham books have differing numbers of pages. One of the recorded years is also incomplete – where Dennis William Long appears to have run out of blank pages! We might presume he recorded the missing information elsewhere – with those supplementary pages having since been mislaid.

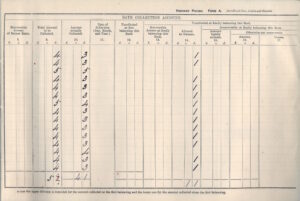

Following the collection of each year’s tax, the current book would have been “handed in” so the year’s details could be witnessed by two Justices of the Peace and then signed off by the Norfolk District Auditor – sometimes supported with a “formalisation” from an official ink-stamp. At the conclusion of each year’s records there’s a double page summary of the data – and this is where all the signatures and stamps were made. In the earlier books, there was also an acknowledgement signature (believed to be) from the rural district council. With the year’s record having been signed off, the book was then returned to the Surveyor for the remaining blank pages to be used for the following year’s collection process.

Dennis William Long appears to have been permitted to keep all the 5 Highway Rate books he had an involvement with, once the data contained (and the tax!) had been made over to the county.

We are currently unaware of any surrounding local villages still possessing Highway Rate books. If that’s the case, might that make these remaining Wreningham books special?

The Data

We have now transcribed all the data from the 5 books into sets of yearly tables. There are 12 complete years of data and 1 partial. Each years’-worth of data is now accessible in its own pdf file – and they are separately linked from further down this page.

The tables list the rateable values of every property in Wreningham – typically more than 100 of them, together with the name of the tenant / occupier. From 1885/6 onwards, every entry also includes the name of the property owner, too. (There are a few gaps in the “owner” columns.) Whilst none of properties are named, the identities of some are straightforward to work out. A few others can be inferred with the help of other information sources.

The first book contains the data recorded by John Bullimore’s in his final three years as Surveyor together with the first year’s data recorded by Dennis William Long. (NB one whole year of data – 1883/4, is missing.) Dennis William Long continued as Surveyor over the period of the remaining 4 books – until 1894. In 1894, the law was changed and the responsibility for this tax collection process appears to have transfered to the district council.

Michaelmas

The dates recorded in the 5 books (including the dates for their signing off) are not precisely the same in every year; there is some variability. However, if we assume that each “rate” year ran from Michaelmas to Michaelmas – this was the day of the year when property tenancies traditionally started & stopped, all the dates within the 5 books fall within the same 12 monthly patterns.

Michaelmas, which is the 29th September, has historical significance in the church calendar and was also a “quarter day” in the legal year.

Links to individual Highway Rate Years

Clink on each of the links below to see that year’s Highway Rate collection record.

The first book:

1880-81 – The Surveyor is John Bullimore

1883-84 – We do not have any records for this year – presumed lost etc

1884-85 – Dennis William Long has taken over as Surveyor

The second book has fewer pages and contains:

1885-86 – From this year onwards, a column has been added to identify property owners.

The third book contains four years of records:

1890-91 – The Surveyor ran out of blank pages – there was only enough space to write about 70% of the 1890-91 record. Presumably, the final 30% is lost?

The fourth book book is made up of the fewest number of pages and only contains information from a single year:

The final book contains two years of records:

In 1894 the law changed and the responsibilty for collecting the information and the tax appears to have moved on to other parties.

Road Repair Material – and local gravel deposits

A field at Fir Grove – Fir Grove had become the home of the Long family in 1889, also included a gravel pit. Over many years, this provided gravel for repairing Wreningham’s roads. Significant quantities of gravel were also once extracted from a pit at southern end of Ashwellthorpe Road, just inside the parish boundary of Ashwellthorpe. This latter gravel pit is also near the former Ashwellthorpe Station.

Areas of Wymondham include extensive gravel deposits. As a result, a lot of Wymondham’s land was better suited to growing trees than crops. In turn, this created Wymondham’s once thriving brush manufacturing industry. Those areas have since been covered in housing – otherwise much of Wymondham might have become a centre for gravel extraction! Today, large quantities of gravel are being dug out of the land (for a wide range of general construction purposes) from just beyond Wreningham’s western boundary – in north Silfield.

Anyone with an interest in our local geology – including where gravel occurs, can find further details on the Geology Viewer. First, zoom into the map to get to a location. Then click on the precise area on interest. A box will pop up; look under “Superficial Deposits” to see any “gravel” references. The website is free to use; the map and all its data are provided by the British Geological Survey.